Introduction

The software-defined vehicle promises a limitless future for automotive OEMs. From autonomy to continuous innovation, software-defined vehicles (SDVs) possess the power to transform the automotive industry. However, automotive OEMs must also transform to successfully realize that future.

To create a successful and profitable SDV program, automotive OEMs must balance traditional, legacy factors while embracing new challenges and a mindset required of software-centric design. Existing within a historically cost-sensitive, largely inflexible legacy ecosystem, the challenges to achieving a successful and profitable SDV program are significant. But, they are not insurmountable.

When navigated correctly, automotive OEMs can not only create a profitable software-defined vehicle but also realize the numerous business benefits by adopting a software-centric approach. The software-defined vehicle is not only the vehicle of the future but also the catalyst to re-imagine the automotive industry for years to come.

Growing cost pressures

By 2030, 35% of the car production in the United States will be electric vehicles.

Automotive OEMs are acutely aware that the path to a profitable software-defined vehicle (SDV) future is littered with roadblocks – most notably, managing costs. The traditional, legacy automotive industry is notorious for massive R&D investment cycles, tight supply chain ecosystems, and a production model optimized for scale. Creating a profitable software-defined vehicle must not only exist within this infrastructure but transform it simultaneously.

Tight and fractured supply chains

Today, recent geopolitical and external factors add to the difficulty of efficiently managing costs while developing a software-defined vehicle. Global instability, including recent geopolitical conflicts and post-COVID retrenchment, has created commodity shortages and fractured supply chains across the automotive industry.

For example, essential commodities for electric vehicle (EV) manufacturing originate from a few countries. Palladium, nickel, and neon gas are critical materials needed for the components of electric vehicles; all these materials depend on Russian or Ukrainian supplies. Most of the raw lithium needed for EV batteries is mined in China, Australia, and Chile, with China controlling more than 50% of the lithium processed and mined globally. Most of the world’s cobalt, manganese, and graphite reserves are exported from a small handful of countries: Brazil, China, the Democratic Republic of Congo, Turkey, Ukraine, and South Africa. Due to geopolitical and other factors, trade with many of these countries – on which automotive OEMs rely – has been restricted or constrained.

In turn, constrained supply chains cause the production and delivery of electric vehicles to slow. Yet, demand continues to increase steadily. By 2030, 35% of the car production in the United States will be electric vehicles.

Developing a profitable software-defined vehicle requires a massive shift in production mechanics from the traditional analog and hardware-focused approach. As SDVs continue to expand, they will require more technology-related components. In turn, OEMs must source more technology materials, such as silicon semiconductors. Tight supply chains where raw materials for these critical components are difficult to acquire pose a challenge for automotive OEMs in both scale and cost per unit. As a result, SDV-enabled vehicles will continue to become more expensive to manufacture.

Labor challenges and software expertise

While automotive OEMs face mounting pressure to innovate faster with SDVs, they must do so while managing several labor and skill challenges.

In 2023, the US experienced major automotive union strikes for pay increases. At the end of October, automotive OEMs, Ford, GM, and Stellantis, reached a multi-year compromise agreement with nearly 50,000 United Auto Workers (UAW) union members. Including an immediate 11% pay increase for employees in the top pay bracket plus four subsequent increases totaling 14% over the life of the agreement (ending April 2028), the three agreements add to the already strained cost base for OEMs.

There is also a need for retraining and new skills within the sector. With software becoming central to vehicle innovation, software developers are also critical to incorporating agile development frameworks within OEMs, such as continuous integration and continuous delivery/deployment (CI/CD) workflows. New skill sets in advanced driver assistance systems (ADAS), sensors, cybersecurity, data science, and data analytics are now coveted to support advances in mobility and connectivity within the industry. Simultaneously, skillsets in internal combustion engines and conventional vehicle technology will fall in demand with the sale ban of petrol and diesel vehicles in Europe starting in 2035. As a result of the transformation in the automotive industry, OEMs must now attract high-quality developers and data scientists amidst significant competition from other sectors. One approach to entice top talent is with the promise of exciting and ambitious innovation programs in SDV development.

The cost of borrowing capital

Lastly, consumer demand for new vehicles is dampened by the rising interest rates, as a large share of vehicles are financed by end consumers. Customers delay new vehicle purchases in such a challenging economic environment, which lowers demand. For example, in a Tesla earnings call, Elon Musk said, “If interest rates remain high or if they go even higher, it's that much harder for people to buy the car. They simply can't afford it." In the third quarter of 2023, average car payments for new and leased vehicles in the US increased year over year at 3.6% for new vehicles and 4.6% for new leased vehicles.

Constrained supply chains, labor demands, reskilling, and increasing costs across the board – managing the cost of developing a software-defined vehicle to remain profitable and successful poses a significant challenge for automotive OEMs. Even EVs, with arguably smaller component complexity and already proven metrics for success, are suffering from the external realities of the current market. However, pursuing a profitable SDV program holds massive potential for automotive OEMs if done correctly.

Realizing lower costs over time with the SDV

Over time, the software-defined vehicle (SDV) will ultimately lower costs for automotive OEMs, enabling them to lower prices without affecting margin and, thus, become more competitive in the marketplace.

Initially, there is intensive upfront R&D investment, but once SDV technology is well understood and more mature, OEMs will make lower R&D investments over time while gaining cost-saving benefits.

The long-term savings enabled by the SDV will come through two main ways: 1) decreased hardware costs and 2) increased efficiency.

Hardware costs

The SDV will enable decreasing hardware costs over time as software can fill the role of special-purpose hardware. Virtual sensors, for example, can significantly increase safety, efficiency, and driving comfort for little cost. The future is commoditized hardware and differentiating software, and the key drivers for this are outlined below.

Rationalization for SDVs

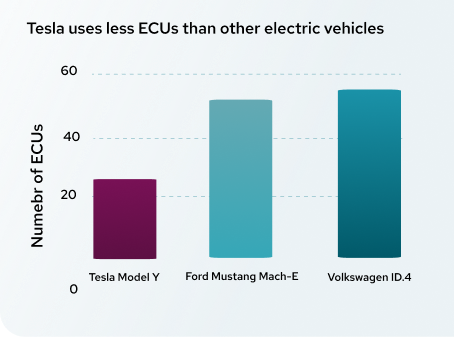

Rationalizing the electrical/electronics (E/E) architecture contributes to the cost savings of SDV programs. Today, numerous individual ECUs are coupled to single functions, estimated at 100 ECUs on average per vehicle. In SDV architectures, domain control units (DCUs), a combination of multiple ECUs and central compute platforms, will consolidate hardware capabilities, decoupling software from hardware by more than 90%. In the SDV, more efficiently integrated hardware leads to lower costs.

For example, Tesla achieved outstanding software development and cost rationalization by efficiently integrating and standardizing the hardware components of control modules. By not reusing legacy ECU parts off-the-shelf, Tesla integrated fewer ECUs in its vehicles. In comparing the electrical architectures of the Tesla Model Y, the Ford Mustang Mach E, and the Volkswagen ID.4, it is clear Tesla has the most streamlined and integrated hardware architecture.

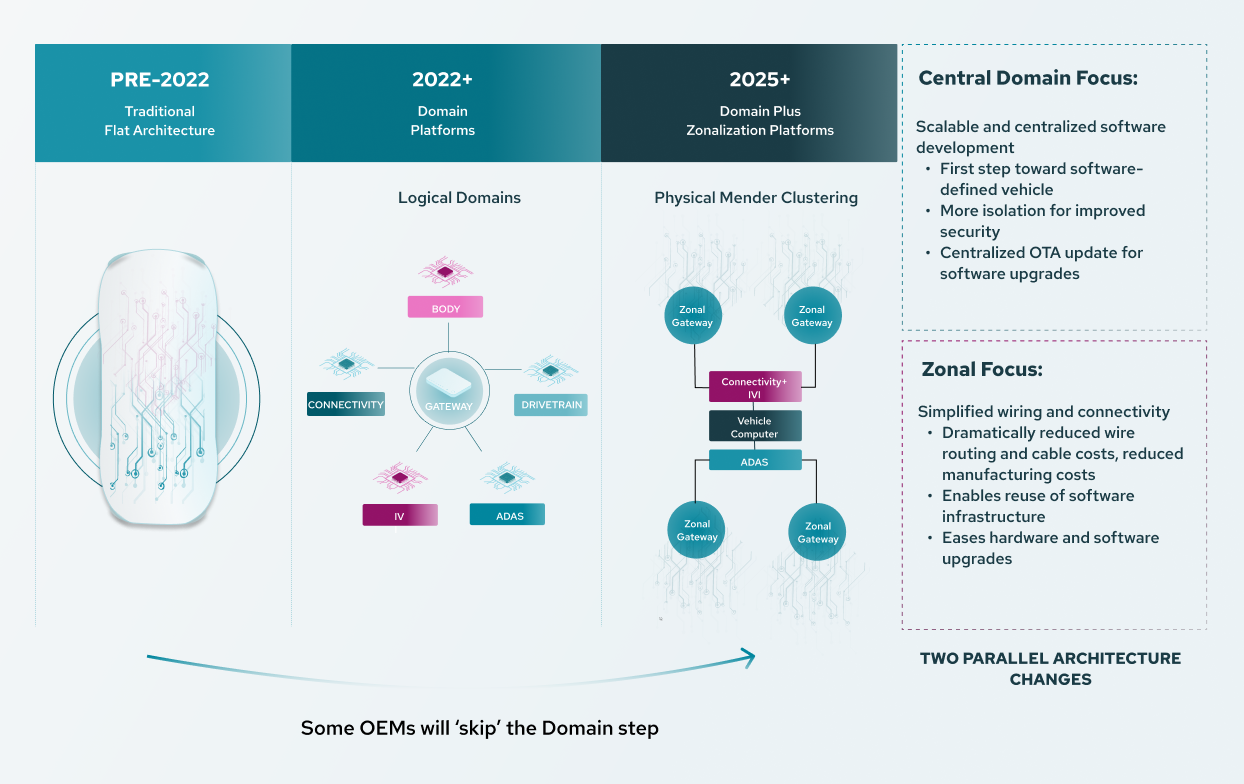

Streamlined zonal software stacks

In conjunction with rationalized hardware, OEMs will design hardware to reuse software. A new zonal and central computing architecture is emerging. Functional domains will be converged into zonal gateways. Zonal gateways will reduce wire routing, cable, and manufacturing costs and enable better reuse of software infrastructure. Then, zonal controllers will connect to sensors and use high-speed communication to transfer large datasets to the central computer running the software-defined functions.

Automotive operating systems (OSs) will run real-time and critical safety functions, while general-purpose OSs will be used for tasks like the infotainment system. Technologies, such as virtualization and containers running on the central computing architecture, will allow these OSs and their software-defined functions to be securely isolated and operate without fear of interference from each other or bad actors. Posix-based systems, like Blackberry’s QNX, will provide safe and reliable OSs for the hardware's abstraction and connectivity functions.

Zonal and central computing architecture

“OEMs lose US$900m annually in the US and Europe from physical recalls, and the number of vehicle recalls for software fixes has doubled in the last two years.”

- Esync Alliance

Efficiency and speed

SDV provides for cost-savings through efficiency, mainly by enabling automation of previously labor-intensive work, especially in OTA updates, cybersecurity, and sales processes.

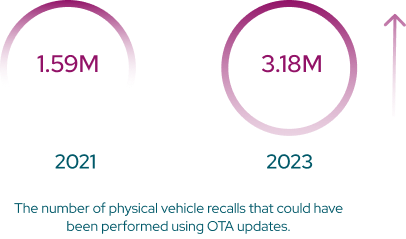

FOTA/OTA update infrastructure

Firmware over-the-air (FOTA) and general over-the-air (OTA) update infrastructure is a fundamental component of SDVs. Where OEMs once relied on physical vehicle recalls to make software updates or changes, an OTA update infrastructure enables OEMs to update vehicle software completely remotely, lowering overall recall (and general update) costs while increasing speed and efficiency.

OTA updates also help OEMs reduce operating costs and expenditures from failures to make critical safety upgrades to affected vehicles on time. Software- and hardware-related safety issues can be solved remotely with OTA updates, and this has the potential to allow OEMs to free up more capital for investment. Today, OEMs must keep substantial resources in reserve to pay fines for recalls and safety upgrades they fail to make on time.

Cybersecurity compliance at scale

OTA update infrastructure is also an essential consideration for vehicle cybersecurity compliance. In addition to ensuring the safety and security of a vehicle, the failure to comply with cybersecurity regulations is often costly in fines, sanctions, or lost investment due to non-approval. Under UN regulation 156 (UNECE R156), which applies to numerous vehicle types, including passenger vehicles, OTA updates must be able to:

- Restore systems if an update fails

- Only execute updates when there is sufficient power

- Ensure updates are executed safely, especially when the update may affect safety-critical systems

- Be able to inform users about each update, including their successful execution (or otherwise)

- Ensure the vehicle is capable of conducting the update

- Be able to inform the user when a mechanic is needed.

SDV sales strategies

SDVs also introduce novel selling strategies. In the United States, Tesla outsold its next 19 rivals combined in the first half of 2023, with 325,291 vehicles sold compared to 214,542. Its cost-effective and efficient direct sales channel, combined with smart branding around the ability to enable in-vehicle features with OTA updates, has allowed it to gain such market dominance. Software is central to Tesla’s brand and sales and marketing success story. In a sense, Tesla created a price premium for the software capabilities within its vehicles; software that has a significantly smaller marginal cost compared to the overall vehicle. This fact has helped them achieve profitability.

In another example, GM has lowered the cost of selling an SDV for the dealer by $2,000. GM uses its own wholly-owned fulfillment centers to deliver an exact configuration of the SDV to a customer within four days, while other OEMs can take anywhere from six to eight weeks to make similar delivery times. In turn, the turnkey functionality of SDV sales reduces inventory costs for dealerships. Machine-learning tools facilitate the stock fulfillment for GM's centers and dealerships. The ML tools get sales information from cloud data on what vehicles sell and where. It allows for lean running at the dealer while also being flexible to change their stock fulfillments without affecting the ability for a customer to buy what they want, exactly when they want it.

Avoiding strategic pitfalls

“Proven 30% cost reduction: impact of OTA on after-sales software maintenance.”

- ARUP

Escalating SDV maintenance costs

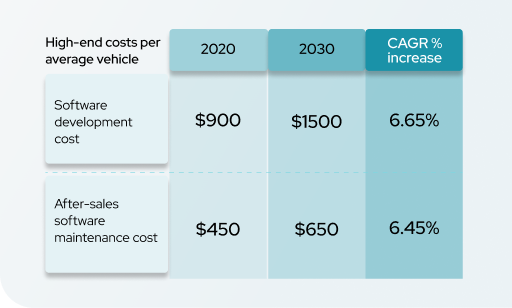

Software is complex, requiring maintenance, updates, and support. As such, it is forecasted that OEMs will have to consider cost increases for software development, maintenance, and bug fixes for the vehicles produced before 2030. A large OEM, such as Volkswagen, expects to have up to 40 million SDVs on the road by 2030. Viewed through this prism, a strategy to control software development and maintenance costs per vehicle at a mass scale is a major consideration for OEMs.

OTA updates enable tremendous efficiencies and cost savings in how software-defined vehicles are maintained and supported. With OTA updates, there is more automation and less human involvement in the process of maintaining software. A tight integration between the OTA update system, software pipeline development, and software quality assurance (QA) processes creates more efficient and faster software deployments to vehicle fleets at far less cost.

Highly specialized, skilled, and lean central teams will be able to support millions of devices with OTA updates and vehicle management software. For example, OEMs can run remote diagnostics and deliver preemptive software patches to vehicle systems using OTA updates. Secure, scalable, and production-grade OTA update infrastructure is a central pillar to reduce costs from after-sales software maintenance.

Navigating the software expertise deficit

Tesla, Rivian, Lucid, and NIO are all software-native technology companies from their origin. Together, these software-native automotive OEMs are exerting significant pressure on US, European, and Japanese OEMs to react and adapt to a new reality. As such, traditional automotive OEMs are looking to address the software expertise deficit cost-effectively.

Traditional automotive OEMs use four main strategies to generate the software competence required to compete in today’s market:

- Build a dedicated software division: One, noticeable trend is for OEMs to create dedicated software divisions. A dedicated division offers OEMs concerted and concentrated resources to build new internal expertise while retaining control to ensure longevity and applicability across the company. Notable OEMs include CARIAD at Volkswagen, M-bition at Mercedes, and Woven at Toyota.

- Create an ecosystem partnership: Strategic partnerships are a traditional lever OEMs utilize, offering speed, market localization, and cost control. This is no different for software competence as it creates a middle ground, allowing the OEM to build SDV expertise without developing everything required internally.

- Acquire a startup: Another traditional route, OEMs historically acquired different competencies through purchasing smaller companies. This route offered speed and cost efficiency over creating competencies internally. Similarly, large and established OEMs can acquire software competence, which GM did with autonomous driving maverick, Cruise.

- Develop a new SDV brand: Minimizing the risk while retaining control, another option is for OEMs to create an entirely new brand. Volvo is an example of this route with its SDV brand, Polestar. It can be more cost-effective: the new SDV brand can introduce a new agile and native digital culture. There is no longer a direct dependency on the large parent organization for SDV innovation, where software development is more costly and slower due to legacy complexities such as entrenched ways of working and skill deficits, which require more external tier suppliers for expensive development to compensate for them.

As the momentum shifts from hardware to software, there is no alternative but to invest in SDVs for automotive OEMs. However, the software-defined evolution and its impact is a known path and one experienced by other industries beyond automotive.

Examples of partnerships designed to enable OEMs to achieve a good balance of speed and cost for SDV programs. Source: SBD Automotive

Managing dealership relationships

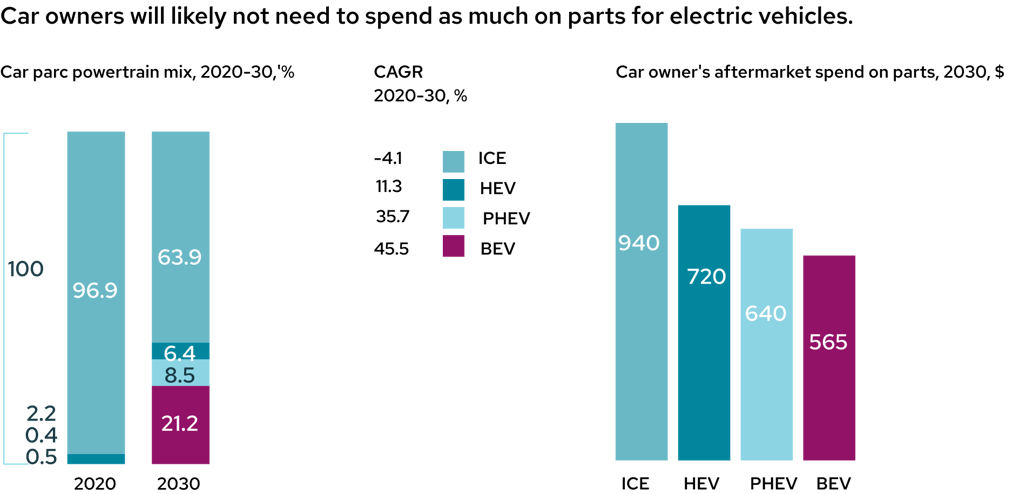

SDVs will also cause the OEM-dealership relationship to evolve. While there are benefits, such as faster delivery times and lower inventory costs, the functionality of SDVs can impact other parts of a dealership business, such as the service department.

For example, it is inevitable that dealerships will make less revenue from replacing parts in battery electric vehicles. McKinsey forecasts that after-sales part replacement spending could decrease by as much as 40% by 2030.

OTA updates could cannibalize some software-related services and recall repairs. Lower in-person visits also reduce the opportunities for the dealership to interface directly with customers and provide additional services. However, it is more likely that a hybrid service model will persist. In West Virginia, OEMs' appeasement to the dealerships’ “right to repair” has already resulted in legislation being introduced to prevent automakers from performing OTA updates directly.

On the other hand, dealerships could also save money from an OEM’s central OTA update architecture by fulfilling basic warranty and repair claims with less overhead costs. GM contends that as new features are added, dealerships will need to walk customers through vehicle changes following an update, thus necessitating ongoing interaction, whether in-person or virtually.

Telematics systems used by OEMs to predict when vehicles will need repair, maintenance, or replacement parts could also help dealerships create revenue-generating opportunities by maintaining regular communication with customers over the vehicle's lifetime and replacing faulty parts before they fail.

Or, in the case of a critical repair, telematics could direct the driver to the nearest dealership, delivering a better experience to vehicle owners while driving service business for dealers. If OTA updates could handle routine upgrades, then dealer service bays and their technicians would be freed up to do higher-profit repair work.

Investing in a software-defined future

Software-defined vehicles offer great promise and are, in fact, a strategic imperative for OEMs. The upfront R&D costs for SDV programs, the complexities of organizational cultural transformation to be truly software-driven, and the engineering zeal to redesign the E/E architecture and service-oriented architecture to embrace the continued benefits of software are real challenges that must be tackled head-on. OEM leaders need to think beyond bill of materials (BOMs) and margins to realize software innovation and the medium-to-long-term market share growth that follows. The future is software-writable, enabling innovation, faster time-to-market, and lower cost at scale over time.

Software Configuration Management is the first major milestone for automotive OEMs developing a software-defined vehicle (SDV) today. For example, a major OEM manages more than 40,000 different software configurations across its fleet. The challenge: to consistently manage ECU software across a variety of vehicle hardware and configurations – which will also likely change over model years. Thus, dependencies between ECUs and current software versions must be taken into account as part of the OTA software update process. In turn, the sheer complexity and scale of software configuration management eliminates the feasibility of manual management. However, edge computing within the vehicle (onboard) and intelligent update synchronization and orchestration can enable automotive OEMs to manage their software – at limitless complexities and scale.

Download the PDF

Related resources

Some similar resources you may also be interested in