As we move toward a more software driven world, industry after industry is up for a strong shake up. Probably no industry, except from the governmentally protected or monopolies, should feel safe. The shift from a physical read-only world (produce a product, ship it, never change it), to a virtual writable world (offer a service, keep improving it) imposes massive challenges to incumbents.

Below follows a thought exercise on how a “hard” industry like the elevator market might be up for disruption. C-suites around the world need to wake up and equip their company for the software revolution before it is too late.

Elevator as a product

Elevators are sold as a product with running maintenance costs throughout its lifetime. Maintenance ensures continued elevator operations, but it is costly both for the customer and the vendor.

The main reason maintenance is expensive stems from vendors needing to send engineers out in the field to conduct the maintenance on the elevators. Further, due to lack of proper understanding of the current condition of an elevator, vendors add unnecessary costs by replacing spare-parts just to be on the safe side. Also, the lack of real-time insight into the actual state of an elevator leads to more urgent service needs due to things that break unexpectedly.

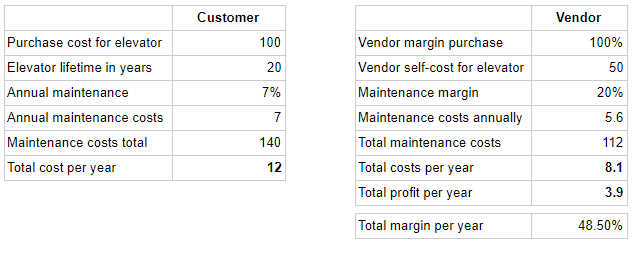

The costs and margins of Elevator as a product

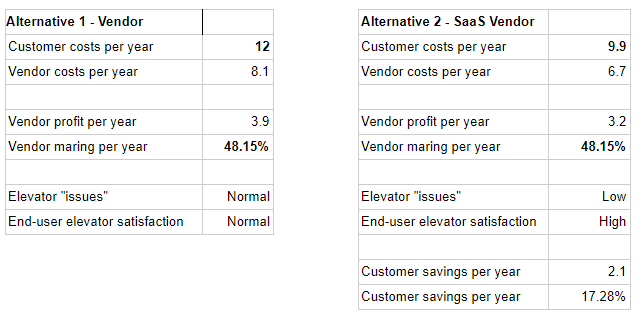

Let’s assume an elevator costs 100. Its lifetime is 20 years, and the customer needs to pay 7% annual maintenance cost. For the customer the total price for the elevator would then be 12 per year.

From the vendor side, let’s assume 100% margin on the selling price of an elevator, and 20% margin on the annual maintenance costs (sold at 7 above). The total annual cost for the vendor would then be 8.1, leaving an annual profit margin of 48.50% (3.9). To keep it simple inflation and compound interests are kept out.

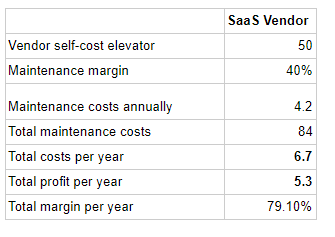

The costs and margins of Elevator-as-a-Service

Now, let’s assume a vendor that starts to offer Elevators-as-a-Service. Thanks to being a software-driven company, it is capable of remotely (OTA) updating the software and gain real-time insight into the state of an elevator and conduct certain functions remotely, like testing that the alarm button works.

Thanks to software, this vendor does not have to send out engineers into the field at the same rate as the traditional vendor. Furthermore, due to real-time insight into the actual state of the elevator, they don’t have to replace parts just to be safe, or “since the engineer is out there anyway”. The rate of emergency calls will drop due to much improved predictive maintenance enabled by software. In conclusion, costs associated with maintenance will be much lower for this vendor than their competitor.

Let’s assume that instead of the traditional margin of 20% on maintenance, this new vendor achieves an annual maintenance margin of 40% due to reduced manual labor and parts costs.

Under this scenario the total annual costs for the new vendor is only 6.7 versus 8.1. Lower costs means higher margin. In this case the margins grow to 79.10% (versus 48.50%).

Why Elevator-as-a-Service will win

As seen above, a new software driven vendor will be capable to both drive down its own costs and improve end-user satisfaction. These competitive wins lead to market share gains.

As an example, by offering an elevator as a service at 9.9 per year instead of the normal 12, the SaaS vendor ends up with the same margins as the traditional vendor. The customer achieves significant savings (17.3%, from 12 to 9.9) 17%. In addition due to the improved predictive maintenance the customer will experience fewer visits by the elevator engineers and great reduction in both planned and unplanned downtime of their elevator. This will increase the end-customer satisfaction. Have you ever been at a big hotel where at least one of the elevators is out of service?

Conclusions

The numbers and arguments presented above illustrate the importance of making products ready for the software driven world. No industry is protected. Companies leading the revolution undoubtedly will gain significant market share. The promise of software driven products includes both improved end customer satisfaction (fewer elevator outages / issues), and reduced costs, savings that can be given to the customer to increase market share, while still keeping industry standard margins. The text is written on the wall.

Recent articles

New Mender experimental AI-enabled feature

Mender in 2025: A year in review with compliance, security, and AI-driven growth

What’s new in Mender: Enhanced delta updates and user experience

Learn why leading companies choose Mender

Discover how Mender empowers both you and your customers with secure and reliable over-the-air updates for IoT devices. Focus on your product, and benefit from specialized OTA expertise and best practices.